“Home sweet home” – Who Owns Our Biggest Assets In A Debt-Based System?

In the last post, we have looked at how a debt-based system enslaves people and how all human effort is channelled into one direction – financial institutions. Unfortunately, this sad fact is obscured by a clever manipulation of our perception that makes us believe that our standard of living improved significantly compared to previous generations. But all depends on how we measure our standard of living. If we measure it by the number of electronic and different kind of gadgets we possess, or how many cars we have then maybe yes, we can say that our standard of living has indeed improved.

But, I bet that for many of us having a good life means something completely different. Imagine if you have a nice, secure job, a guarantee of a good salary, enough time for the family and leisure, a comfortable and nicely located house and of course the perspective for a financial freedom at a reasonable age so you can fully enjoy your life. Isn’t it something we would all call a good quality of life?

But how many of us can tick all these boxes? How many of us can say I have a nice, comfortable life, I earn good money and soon I will be in the position to pay off all my debts and step down to enjoy the rest of my life if I wish to. Probably not many of us, but despite this fact we still feel that we are doing not bad, we have lots of things, and generally speaking we feel abundance around us, at least in the developed countries.

But the main question we should ask ourselves is – Are all these things really ours? The answer to this question is of course – NO, they are NOT.

As we already know, in the debt-based system, most of “our” money is created by banks and it belongs to the banks. If tomorrow banks will decide to claim all their money back, we will all be living in a misery. As the credit manager of the Federal Reserve Bank of Atlanta, Robert Hemphill once said:

“We are completely dependent upon the commercial banks, someone has to borrow every dollar we have in circulation, cash or credit. If the banks create ample synthetic money we are prosperous, if not we starve. We are absolutely without permanent monetary system”.

Unfortunately, this situation worsens with every new generation that is forced into even larger debt to cover their fundamental needs or shall we rather say sustain their “improved” standard of living. Let’s look at an example of a property ownership. Who owns “our“ houses?

For many of us buying a house is an important event in the life and probably the biggest investment. It provides a safe place for us and our family to live in. It is an unquestionable fact that today for a family to buy a house means to tie up with a life-long debt. The average time of mortgage is constantly growing. In the UK having a 35- years mortgage is not a surprise. Even mortgages for 50 years and over came into existence in the modern economy.

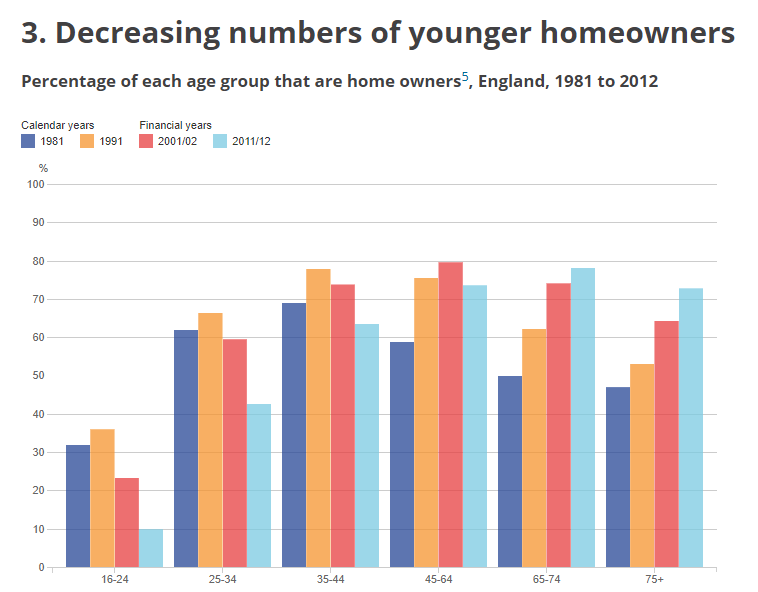

But what was the situation of our parents and grandparents? Alan Holmans, the leading authority on the history of housing in the UK stated – “in 1930s mortgages were typically at 6% for 20 years, the average life of the mortgage was 8 years! It was estimated that at that time buying a house cost the equivalent of about twice a man’s yearly salary”, by 1960s this rose to 2.9 times and in 1980s reached 4 times the annual salary.

If we look at the situation today, the average UK salary is about £27k/annum (some are not even lucky to have this) and the average house price £226k. This means the average cost of the house is equal to 8 times the average annual salary. I think we can all figure out what this will be for our children if nothing will change. This rapid increase in a mortgage lifespan and the salary/house price ratio indicates that less and less of us really own “our“ house and the dream of a financial freedom is fading away and for some is gone forever.

Still, those who have their house mortgaged feel lucky. There are so many young people and families who don’t even dream about having a mortgage unless their parents stand behind. As we are battling to support our needs and “good quality” life we have to understand that our children will need us to support theirs. Can we afford it? Is this situation sustainable? What does it mean for us and our children?

In a debt-based system, our own, commercial and government debt is constantly growing causing our disposable incomes or commercial profits to be smaller and smaller. This triggers even more need for debt to sustain our usual standard of living. As a society we don’t own “our “ things, we rent them from the financial institutions and pay a high price for being able to do it.

So, if we really want to own our houses and other things, and if we want our children to have the same opportunity in the future, we must all understand a devastating effect of the debt-based system on our lives. We must start by understanding money and how it works and pass this knowledge to our children as soon as possible so they are properly equipped to be able to drive necessary changes that will allow us to take ownership of a part of the wealth which we are entitled to.

If you are looking to impart this powerful knowledge on your children, then why not consider the Money Mystery Book Series. The Money Mystery series goes beyond the typical what is money and how to save type books! The series has been developed to raise an awareness of the link between money and social and environmental problems, and foster the creation of the new, independently and critically thinking generation that will drive positive changes in our society.